You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Payment of the tax needs to be made to the Director General of Inland Revenue within 1 month after the payment has been made to the payee.

First Time Income Tax Registration Get E Pin Number Online How To Register Your Income Tax Account For First Time 𝐇𝐨𝐰 𝐭𝐨 𝐠𝐞𝐭 𝐲𝐨𝐮𝐫 𝐫𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐞 𝐩𝐢𝐧 𝐧𝐮𝐦𝐛𝐞𝐫 𝐨𝐧𝐥𝐢𝐧𝐞 𝐰𝐢𝐭𝐡𝐨𝐮𝐭 𝐠𝐨𝐢𝐧𝐠 𝐭𝐨 𝐚

You can find this information in the EA Form provided by your company.

. Calculation is based on Income Tax Act 1967. Please ensure you have submitted your e-Daftar application before submitting the supporting documents using the feedback form. UBB is a trust company which established more than 30years in market.

LEMBAGA HASIL DALAM NEGERI MALAYSIA HASiL ANJUR PERSIDANGAN PERCUKAIAN KEBANGSAAN 2022 KALI KE-22. You will earn 5x points for dining department store purchases and overseas spend plus 5000 bonus points monthly when you spend RM1500 or. Yes when you donate to UNICEF you get to enjoy tax exemption benefits from the Inland Revenue Board of Malaysia LHDN for donations of RM50 and above as according to section 446 of the Income tax Act 1967 Malaysia.

Yes you need to register an income tax number if you are a. You may obtain your supporting document by emailing WHToperasihasilgovmy. Make sure to get your handphone number down correctly as LHDN will send you a TAC when you sign and submit your e-form and your bank account number must also be accurate if you want to get your tax refund.

Additionally you now have the option to choose DuitNow as your preferred payment method for tax refunds. Just be sure to select Payment. If unsure you can check the status of the charitable organisation on LHDN website.

Individuals who run a business even if the business suffers a loss. Remember you must ensure the organisation you donate to is approved by LHDN. You may refer to the screenshot from SOCSO FAQ on the SOCSO registration number.

Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National Tax Conference. Instead add a 0 at the end of your tax reference number and make sure that your reference number contains 11 digits. Youll then see a page with your tax reference number.

What are the top benefits of Visa Platinum credit card. How Do I Pay PCB Through to LHDN Part 3 of 3 was uploaded on 22 July 2020 and recently updated on 17 Aug 2022. Company must submit their Form CP107D and agents must have.

This Cash trust launched since 2014 3 years tenure with bankruptcy proof creditor proof and tax free benefits as normal trust. Once you have filed all the relevant tax amounts charged on your chargeable income. You can file Form 1040-X Amended US.

Cash advances cash withdrawals charges for cash advance or cash withdrawals annual fees interest finance charges late payments fees disputed transactions or any other form of service or miscellaneous fees charged by us. Withholding tax will be deducted based on the rate listed in the table regardless if the tax has already been deducted or not. 2 ways to check SOCSO or PERKESO number.

You do not have to key in the letter C if your tax reference number contains this alphabet. It is stated on the SOCSO FAQ website that the SOCSO number is Malaysia NRIC number. So far every year the trust giving 7 return per year.

7 minutes Editors note. This ruling takes in effect as of 1st January 2022. See Form 1040-X Amended US.

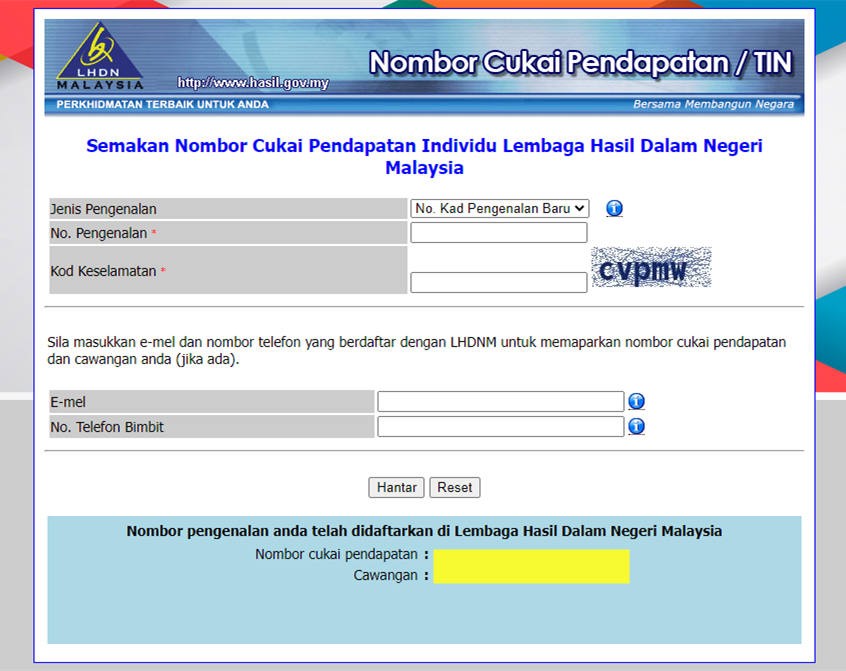

Check if the total monthly tax deductions MTDPCB displayed is correct. As mentioned above our SOCSO or PERKESO number is our Malaysian NRIC number 12 digits without the dash. Click on the link that says Please Check Your Income Tax No.

The minimum income requirement of RM36000 per annum. The 2 withholding tax is charged on the sales services transactions and programs carried out by the agents dealers and distributors. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR and tax year 2021 or later Forms 1040-NR.

You may know how to calculate Monthly Tax Deductions MTDPCBBut do you know how to pay PCB through to Lembaga Hasil Dalam Negeri LHDN or the Inland Revenue Board of Malaysia IRBM. SQL Payroll software ready with all malaysia government report EPF Borang A SOCSO Borang 2 SOCSO Borang 3 SOCSO Borang 8A EIS Borang 1 EIS Borang 1A EIS Borang 2 EIS Borang 2A EIS Lampiran 1 Income Tax CP39 CP39A Income Tax CP 39A Income Tax CP 22 Income Tax EA Form Income Tax EC Form Income Tax CP 8 CP 159 Income Tax e Data. For every donation you make.

For every donation of RM50 and above it is also tax exempt under Section 446 of the. The return will be direct transfer to our bank account. A calculation is done to determine if you have tax to pay or are indeed eligible for a rebate.

Income Tax File Registration. If you have no ideas to do the e-filing LHDN or you just need a clear guide to complete Malaysia Personal Income Tax 2021. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021. You still have the option to. Submission of e-Daftar supporting documents can also be made via our e-daftar.

Retail purchase excludes the following transactions. First at the top of the page to ensure that you have not already not registered previously. E-Daftar is an income tax file registration system for new tax payer to get their income tax file number.

LHDNs CIMB account 800 766 957 is no longer in use. Individual with single status who receive employment income in more than RM34001 per year after EPF deduction Married individuals and unemployed spouses who receive employment income in excess of RM46001 per year. Individual Income Tax Return Frequently Asked Questions for more information.

Tax rebate for Self. You must be above 21 years old and the minimum annual income requirement is RM36K.

Income Tax Of An Individual Lembaga Hasil Dalam Negeri

Steps To Apply E Pin Online L Co

Here S A How To Guide File Your Income Tax Online Lhdn In Otosection

Income Tax Number Registration Steps L Co

Finance Malaysia Blogspot Tax Refund Email Sent By Lhdn So Good Ah

6 Income Tax Faq 大马个人所得税需知 Income Tax Income Tax Return Online Taxes

3月1日起可开始报税 附上自行上网报税指南和截止日期 Leesharing Apply Job Word Template Ways To Save

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

.png)

How To Check Your Income Tax Number

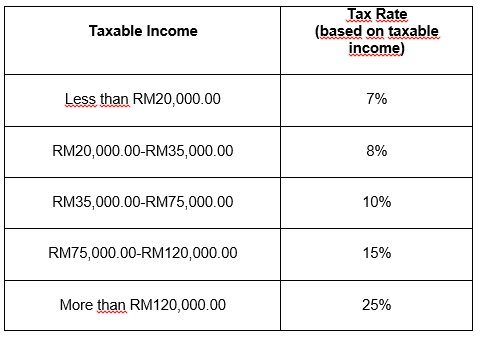

Solved In Doing An Income Tax Calculation Lhdn Was Given Chegg Com

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To Check Your Income Tax Number And Tax Identification Number Leh Leo Radio News

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia